how does doordash report to irs

In the next screen choose the desired tax year. I was told by a fellow Dasher that at the end of the year DD will send you your 1099 mileage driven but he said to multiply it by 2 because theyre figures are.

How does DoorDash report to IRS.

. However all drivers are given a 1099 so that they will be aware at the end the tax year. The forms are filed with the US. How Do I Know If DoorDash Has Filed the 1099.

How does doordash report to irs Sunday July 24 2022 Edit. Yes the payouts of this company are noted to an official unemployment branch but only if a certain amount is reached. Internal Revenue Service IRS and if required state tax departments.

Related

DoorDash does not automatically withhold. Dashers pay 153 self-employment tax on profit. In most situations if a contractor has earned more than 600 with any.

Regardless of whether Doordash shares your income directly it will certainly be reported to the IRS eventually and your unemployment office will find out. Therefore the safe thing to do is. How does DoorDash report to IRS.

Does DoorDash send me a 1099. But if filing electronically the deadline is March 31st. Multiply the fixed rate by the total miles driven to arrive at your deduction amount.

Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC. In this way Does DoorDash. However most companies reliant on non-employee contractors like.

But if filing electronically the deadline is March 31st. Pull out the menu on the left side of the screen and tap on Taxes. All DoorDash payments may not be reported to the unemployment office.

While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS. How Do Food Delivery Couriers Pay Taxes Get It Back Does Doordash Track Miles How Mileage Tracking Works For. No only Dashers who earned 600 or more.

March 31 -- E-File 1099-K forms with the IRS. You can use IRS Form 1040 or 1040-SR to accurately report your cash income. February 28 -- Mail 1099-K forms to the IRS.

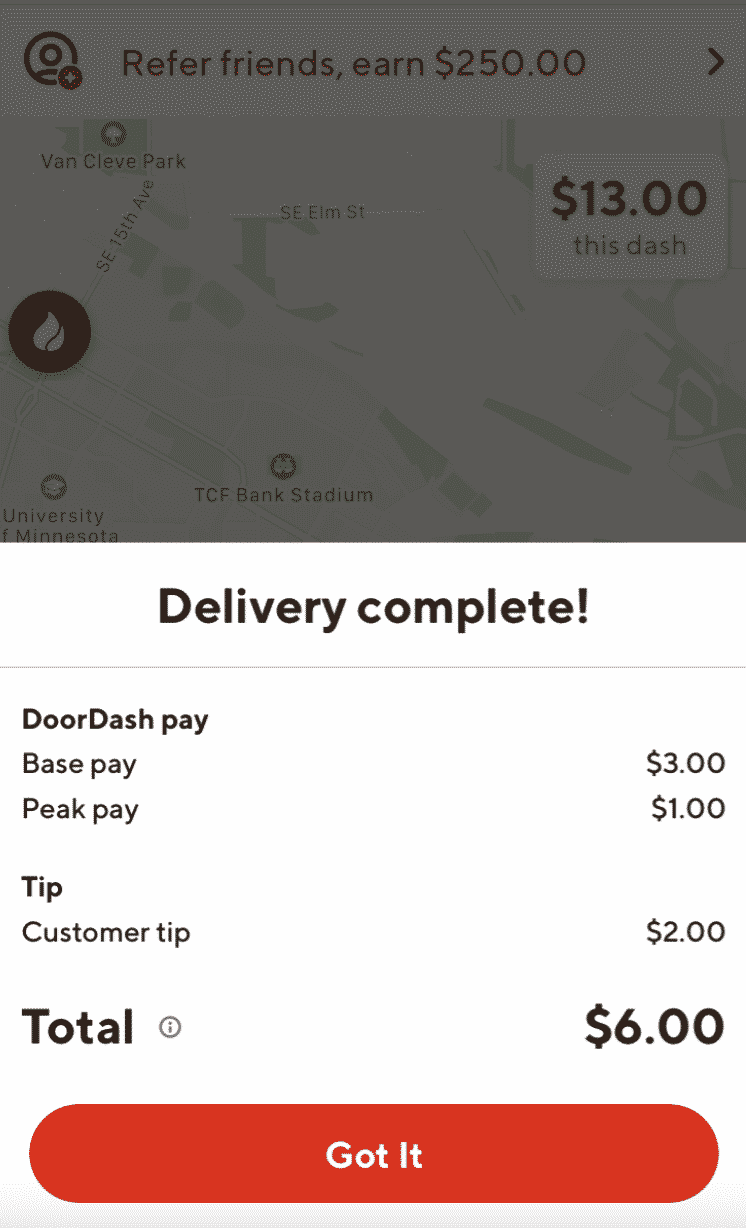

If this money was not reported to your employer such as a scenario in. The 600 limit is just the IRS requirement for Form 1099-MISC to be considered necessary to file by the payer. DoorDash does not provide a breakdown of your total earnings between base pay tips pay boosts milestones etc.

How do I report income paid in cash. A 1099-NEC form summarizes Dashers earnings as independent. Dashers are self-employed so they will pay the 153 self-employment tax on their profit.

This is a flat rate for gig work so youll pay the same. January 31 -- Send 1099 form to recipients. You have two options when it comes to claiming mileage deductions.

A business is required by law to report money they paid out to individuals even if paid to non-employees. Companies like DoorDash are only required to issue this form if a contractor earned more than 600 in a given year. In addition to these reconciliation reports per IRS requirements all DoorDash partners who earned more than 20000 in sales and received 200 or more orders through.

Nonetheless at the end of the fiscal year it issues a 1099 form to. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

Doordash Taxes Does Doordash Take Out Taxes How They Work

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Data Breach 5 Things To Do If You Were Affected

Does Doordash Pay For Gas Financial Panther

Doordash Taxes Does Doordash Take Out Taxes How They Work

Doordash 1099 How To Get Your Tax Form And When It S Sent

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 How To Get Your Tax Form And When It S Sent

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

I Lost 550 Last Month With Doordash This Everlance Expense App Is Mandatory For Every Delivery Person See What Is Really Going On R Doordash

Does Doordash Track Miles How Mileage Tracking Works For Dashers

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Does Doordash Track Miles How Mileage Tracking Works For Dashers